Safeguard your Estate & Legacy the ease way

From prized possessions to cherished pets – seamlessly share everything important with those who matter most.

-

AI based Step-by-Step guidance

-

FREE Will & Trusts Documents

-

Share details with family

As featured in

5000+ users trust Inherrit. You can too!

5000+

Users (Growing daily)

170+

Partners (Growing weekly)

£1m

(Average assets)

Assets worth Billions are unclaimed or forgotten around the world.

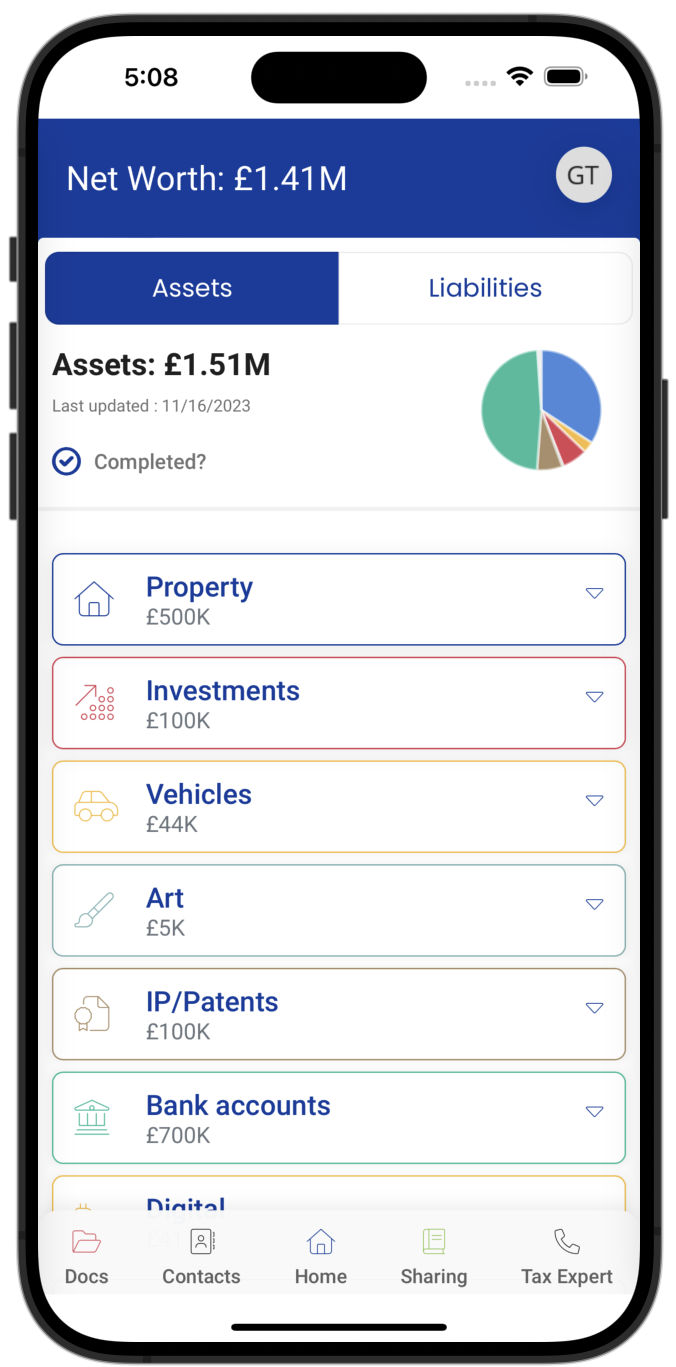

Billions of dollars in assets remain unclaimed, primarily because the rightful heirs are often unaware of their existence. This lack of awareness can lead to significant losses for individuals and families. However, there is a solution to this problem. By utilizing the Inherrit app, you can ensure that your assets are properly documented and accounted for. With its user-friendly interface and comprehensive features, the app empowers users to keep track of their assets and designate beneficiaries, minimizing the risk of assets going unclaimed. Don’t let your hard-earned assets slip through the cracks—download the Inherrit app today for free and take control of your financial legacy. Download it today for free!

Take Control of Your Future with 3 simple steps

Simplify your Estate Planning

A study shows 60% of residents do not have a will or estate plan in place.

Are you one of them? Download Inherrit today and make sure your wishes are known.

Estate Planning FAQs

- Inventory of Assets:

List all assets, including real estate, bank accounts, investments, and personal property. - Create a Will:

Clearly outline how you want your assets distributed. - Consider a Living Will and Healthcare Proxy:

Specify medical treatment preferences and designate someone to make healthcare decisions on your behalf if needed. - Establish Powers of Attorney:

Appoint individuals to manage financial and legal matters in case you’re unable to do so. - Explore Trust Options:

Determine if trusts, such as revocable living trusts or irrevocable trusts, align with your goals. - Review and Update Beneficiary Designations:

Ensure all retirement accounts, life insurance policies, and other financial accounts have current beneficiaries. - Minimize Tax Implications:

Consult with a tax professional to explore strategies for minimizing estate taxes. - Guardianship for Minor Children:

Designate guardians for your minor children in case of incapacitation or death. - Consider Charitable Giving:

If charitable contributions align with your values, include them in your plan. - Regularly Review and Update:

Periodically revisit and update your estate plan to reflect life changes, such as marriage, divorce, births, or significant financial shifts. - Funeral and Burial Preferences:

Communicate your preferences regarding funeral arrangements and burial or cremation. - Organize Important Documents:

Keep important documents, including your will, trusts, and insurance policies, in a secure and accessible location. - Communicate Your Plan:

Ensure key family members and beneficiaries are aware of your estate plan and its details. - Consult with Professionals:

Seek guidance from an estate planning attorney, financial advisor, and tax professional to ensure your plan is comprehensive and legally sound. - Consider Long-Term Care:

Evaluate options for long-term care and plan for potential costs. - Evaluate Business Succession:

If you own a business, create a plan for its succession or continuation. - Secure Digital Assets:

Include instructions for the management and distribution of digital assets, such as online accounts and cryptocurrencies. - Document Personal Wishes:

Provide guidance on personal matters, such as the distribution of sentimental items or specific family traditions.

While it’s possible to create a basic estate plan on your own using online resources, consulting with an experienced estate planning professional is highly recommended. They can provide personalized advice, ensure all legal requirements are met, and help you navigate complex issues such as tax implications and asset protection. Professional guidance helps tailor your estate plan to your unique circumstances, minimizing potential pitfalls and maximizing its effectiveness.

No, estate planning and trusts are related but distinct concepts. Estate planning is the overarching process of arranging your affairs to manage and distribute your assets, while a trust is a specific legal entity that can be created within an estate plan. Trusts serve various purposes, such as avoiding probate, minimizing taxes, and providing ongoing financial management for beneficiaries. Incorporating trusts into your estate plan is a common strategy for achieving specific goals in wealth transfer and asset protection.

Estate planning encompasses a broader set of strategies beyond a will. While a will specifically outline how your assets should be distributed after your death, estate planning involves a comprehensive approach to manage and protect your assets during your lifetime. This may include tools like trusts, powers of attorney, and tax planning to ensure your wishes are carried out efficiently and tax-effectively.

Estate planning lawyers and advisors in the UK can assist you in creating a comprehensive plan to manage your assets, minimize inheritance tax, and ensure your wealth is distributed according to your wishes. Their expertise covers wills, trusts, and other legal strategies to protect your estate and provide financial security for your heirs.

Without an estate plan in the UK, your assets may be distributed according to intestacy laws, which may not align with your preferences. This can lead to potential disputes among family members, and the lack of specified guardianship arrangements for minor children could result in court decisions. Additionally, it may lead to increased

Estate planning in the UK is crucial to ensure the orderly distribution of assets and wealth, minimising inheritance tax liabilities, and providing for loved ones according to your wishes. It offers peace of mind and helps avoid legal complications for your beneficiaries.

The cost of estate planning in the UK may vary depending on your personal and financial situation. According to my web search, basic fees for a UK-based estate plan, with no outside interests, could range between £500 and £3,000. This would include drafting the relevant paperwork, such as wills, powers of attorney, and trust deeds, as well as receiving expert counsel and registering the documents. It’s best to consult an advisor to determine he cost.

Estate planning is a process that involves planning for your assets, health, and care during your life and after your death. It usually includes a will, but also other elements, such as a power of attorney, a trust, a business continuity plan, and more. Estate planning aims to protect your interests and wishes, as well as reduce taxes, fees, and conflicts among your heirs. More info at Estate planning – Wikipedia

Estate planning fees are generally not tax deductible on your income tax return unless they are directly related to business assets or income-producing property. However, legal fees related to the administration of the estate, such as probate or estate tax issues, may be deductible on the estate’s tax return. You should consult with a tax professional or an estate planning attorney to understand how these rules apply to your specific situation. More info at IHTM10361 – Deductions from the estate: introduction – HMRC internal manual – GOV.UK (www.gov.uk)