Top 5 [Free] Tools for Digital Estate Planning: How to Create a Digital Estate Plan

What is digital estate planning?

Digital estate planning is the process of organizing and managing a person’s digital assets and online accounts in the event of their death or incapacity. It involves identifying and documenting all digital assets, such as social media accounts, email accounts, online bank accounts, digital photos, and other digital files. The purpose of digital estate planning is to ensure that these assets are handled properly and prevent unauthorized access, protect privacy and financial interests, and mitigate risks such as cybersecurity threats and privacy concerns. A digital estate plan typically includes details on how to access these accounts and assets, who should be granted access, what should be done with the data, and how to manage any outstanding debts or liabilities related to these accounts. It is important to regularly review and update the plan to ensure it remains effective. See our article on Digital Estate Planning Planning.

Top 5 Free tools you can use today for Digital Estate Plan

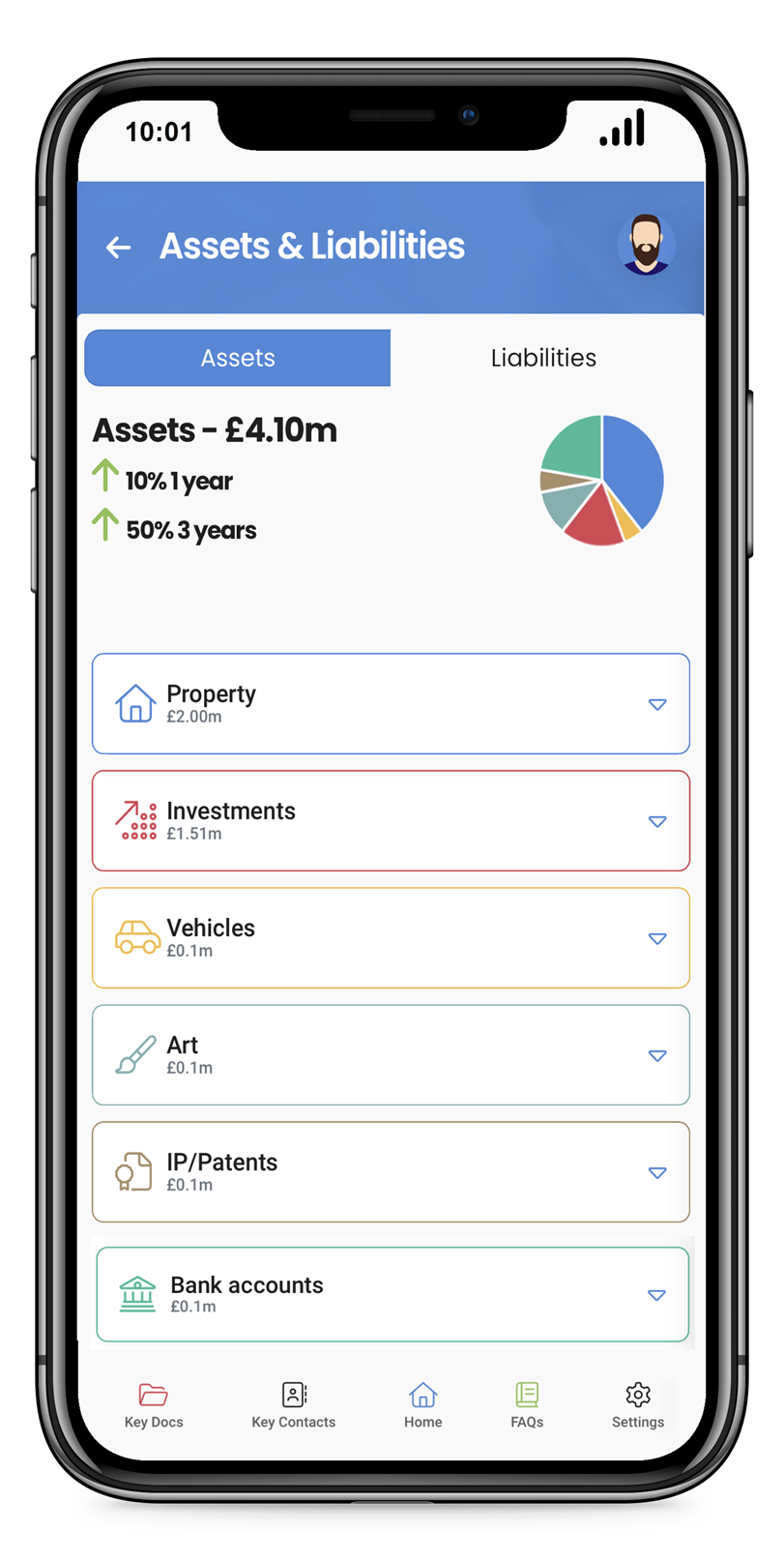

1. The Inherrit app:

This innovative and user-friendly mobile app is a comprehensive solution for all your estate planning needs. With a deep understanding of the importance of seamless inheritance planning, Inherrit app offers you a platform to create, store and update your will in an encrypted, secure environment. This gives you the peace of mind that your final wishes are securely documented and readily available for your beneficiaries when required.

Inherrit stands out by offering a feature that lets you catalogue all your digital assets. This could be anything from online bank accounts and cryptocurrency holdings, to email accounts, social media profiles and cloud storage filled with personal memories. By creating this digital inventory, you ensure that all of your valuable assets are accounted for and can be efficiently managed and distributed as per your will.

With its reminders feature, it prompts you to review and update your will and asset catalogue periodically, or when significant life events occur, so nothing falls through the cracks.

2. Microsoft Excel

Microsoft’s Excel is more than just a simple tool for calculations and data analysis. It offers a broad range of features that make it an invaluable aid in organising and planning your estate and inheritance matters.

Excel allows you to catalogue and organise all your assets, both digital and physical, in a secure, structured manner. This comprehensive list can be customised to your needs, including columns for detailed descriptions, values, and beneficiary details, ensuring nothing is left out or overlooked. Utilising Excel’s password-protection feature, your compiled estate information can be kept secure and private. This gives you the confidence that your sensitive data is protected, and accessible only to those you entrust with the password.

The flexibility of Excel also extends to keeping your estate planning up-to-date. With regular reminders set up in your digital calendar of choice, you can periodically review and update your asset list and related documents. Plus, given Excel’s ubiquitous presence across various platforms, your information can be easily accessed and updated from your desktop, laptop, or even on-the-go via the mobile app.

Excel’s capabilities to create charts and visualise data can help give a clearer picture of the distribution of your assets, assisting you in making informed decisions regarding your estate planning. While Microsoft Excel might not be a traditional estate planning tool, its powerful, flexible, and security features make it a potent ally in managing and planning your estate and inheritance matters.

3. Microsoft Word

This classic word-processing software from Microsoft can prove to be an unexpectedly useful tool for managing and planning your estate and inheritance.

Word’s extensive formatting options allow you to create a comprehensive, structured document to record all your assets, both physical and digital. This can include an itemised list, categorised as needed, of all your possessions with details regarding their value and assigned beneficiaries. The variety of templates available also offers a starting point, saving you time and effort in organising your information.

To ensure the security of your sensitive data, Word has a feature to protect your documents with a password. This adds an extra layer of protection, ensuring that your confidential information remains accessible only to those to whom you’ve entrusted the password. Another advantage of using Word is its accessibility and ease of use. You can update your estate planning documents regularly to reflect any changes in your assets. With Word’s availability across various platforms, your estate planning document can be accessed and updated from your desktop, laptop, or even your smartphone via the mobile app. Word’s ability to create tables, insert images, and manage layouts allows you to visualise the distribution of your assets, helping in informed decision-making regarding your estate.

While Microsoft Word might not be the first tool that comes to mind for estate planning, its versatility, ease of use, and security features make it a dependable tool for managing and planning your estate and inheritance.

4. Good old Pen and Paper

An age-old method, the humble pen and paper offer a straightforward, tangible approach to estate and inheritance planning. Using pen and paper allows you to create a comprehensive and organised list of all your assets, both digital and physical. This tangible record offers a clear overview of your estate and can be categorised and structured as needed, detailing the value of each asset and assigned beneficiaries.

In terms of security, handwritten documents stored in a safe place offer a degree of confidentiality that digital methods can’t always guarantee. Your sensitive data is protected from the risk of online breaches, accessible only to those who you entrust with the physical document. One of the greatest advantages of using pen and paper is its simplicity and accessibility. Anyone, regardless of their technical skill, can use this method to document and update their estate planning. Regular reviews can ensure your list stays updated to reflect any changes in your assets.

Handwriting can provide a personal touch to your estate planning. In moments of decision-making regarding your estate, the physical act of writing can offer a more reflective, thoughtful approach to the process. Though traditional, the pen-and-paper approach to estate planning offers simplicity, confidentiality, and a personal touch, making it a reliable method for managing and planning your estate and inheritance.

5. LegalTemplates

A leading online resource for legal document templates, LegalTemplates provides a straightforward and efficient solution for estate and inheritance planning. With its vast library of legal templates, including those specifically designed for estate planning, LegalTemplates allows you to create detailed and structured documents capturing all your assets – both physical and digital. These templates offer a clear layout for listing all your possessions, detailing their value, and specifying the assigned beneficiaries.

Regarding data security, LegalTemplates has robust measures in place to protect your sensitive information. Your documents and their contents remain confidential, with access strictly restricted to your chosen individuals. The primary advantage of LegalTemplates is the ease and speed with which you can create complex legal documents. This simplicity helps those unfamiliar with legal jargon, saving them time and potential legal fees. Regular updates to reflect changes in your assets are easy to make, and the platform provides prompts to keep your information relevant.

As a digital tool, LegalTemplates may not provide a personal touch to your estate planning, but its simplicity, security, and comprehensiveness make it a reliable choice for effectively managing your estate and inheritance planning.

Things to consider while selecting a digital estate planning tool

1. Comprehensiveness

The best digital estate planning tools cover all aspects of estate planning. They should provide functionalities for creating wills, documenting your physical and digital assets, and assigning beneficiaries. An inclusive tool is crucial for making sure nothing is overlooked in your estate plan.

2. Ease of Use:

An ideal digital estate planning tool should be user-friendly, intuitive, and easy to navigate. It should have a clean interface and straightforward instructions.

3. Security:

Your estate planning data is sensitive and private. It’s essential to choose a tool that guarantees top-notch security for your data. Look for tools that have robust encryption, secure logins, and other privacy features.

4. Legality:

The tool should provide guidance to help ensure that your plans are legally sound. Some tools offer the ability to have legal professionals review your plans or access to legal advice, which can be beneficial.

5. Flexibility:

Look for tools that offer flexibility. The ability to make changes easily, like updating your asset inventory or changing beneficiaries, is important.

6. Value for Money:

While there are free tools available, some paid tools offer additional features that may be beneficial, such as access to legal professionals or extra layers of security. Consider the pricing of these tools and what you get for your money.

7. Alerts and Reminders:

Tools with alerts and reminders can help you keep your estate plan updated. They can prompt you to review your plan regularly or when significant life events occur.

8. Customer Support:

A tool with excellent customer support can be invaluable. Whether you have questions about how to use the tool or need help troubleshooting an issue, responsive and knowledgeable customer support can make the process much smoother.

9. Digital Asset Management:

With our digital footprints expanding, it’s essential to choose a tool that includes digital asset management. It should provide options for documenting digital assets like online accounts, digital files, and cryptocurrency.

10. Access Upon Death:

Finally, consider how the tool handles access to your information upon your death. Who can access your information? How is that access granted? This is a crucial feature to prevent your assets from being unclaimed or mismanaged. What to consider when making a digital estate plan

FAQs

1. What is a digital estate planning tool?

A digital estate planning tool is an online software or application that helps you create, manage, and update your estate plan, which includes your will, documentation of your assets, and your wishes for their distribution after your passing.

2. Are digital estate planning tools safe to use?

Yes, reputable digital estate planning tools utilise advanced encryption technology and robust security protocols to protect your personal information and data.

3. Do these tools provide legally binding documents?

Many digital estate planning tools provide templates and resources for creating legally binding documents, but it’s advisable to consult a legal professional to ensure that your documents comply with local laws and regulations.

4. Can I update my estate plan on these tools?

Yes, one of the advantages of digital estate planning tools is that they allow you to update your plan whenever necessary, ensuring it remains current and reflective of your wishes.

5. Do I still need a solicitor if I use a digital estate planning tool?

Yes. While these tools can provide valuable resources, it’s still important to consult with a solicitor, particularly for complex estates or specific legal advice.

6. Can these tools handle digital assets?

Yes, many digital estate planning tools provide options for documenting and managing digital assets, such as social media accounts, digital photos, online banking and trading accounts, and even cryptocurrency.

7. Are digital estate planning tools expensive?

The cost varies significantly. Some tools are free to use, while others charge a fee for advanced features or services. It’s important to choose a tool that suits your budget and your needs.

8. Can I share my estate plan with my family through these tools?

Many digital estate planning tools allow you to selectively share information with your family, loved ones, or legal representatives, fostering transparency and open communication.

9. How user-friendly are digital estate planning tools?

Most of these tools are designed with user-friendly interfaces to make the estate planning process as simple and straightforward as possible. However, the level of user-friendliness can vary between tools.

10. Can digital estate planning tools help with tax planning?

Some digital estate planning tools offer features that can help with tax planning, such as inheritance tax calculators or guidelines on tax-efficient asset distribution. However, for detailed tax advice, consulting with a tax professional is recommended.